There’s a tweet about someone investing what could most likely be your yearly annual income ($46,300) on a picture of a gray rock as an “NFT”, you saw it, and now you’re wondering what it is, why it is gaining so much attention, and how you can get involved. In this article, we will be covering the nitty-gritty of NFTs.

Crash course on tokens and token standards

Before we get right into the explanation of NFTs, you must first understand what tokens and token standards are and how they work on the blockchain.

Tokens

The word “token” has been used to represent several things in the crypto space, from referencing “crypto-assets” to other cryptocurrencies aside from Ethereum or Bitcoin (also known as altcoins). Technically, it is still accurate, but the main difference between a token and a cryptocurrency is that tokens are built on existing blockchains with smart contracts (immutable programs on the blockchain executed when certain conditions are met).

A token can be defined as a digital asset or utility built on a blockchain. You can use them for various functions like representing loyalty points offered by decentralized platforms or altcoins. Examples include :

- Payment Tokens: These tokens allow for payments of goods and services through the blockchain with no intervention of a financial institution, making decentralized exchanges possible. E.g., USDT and SHIB.

- Security Tokens: These tokens act like conventional securities like shares and bonds or stock. They can serve as financing opportunities for companies that are not publicly traded or listed on the stock exchange.

- Non-fungible tokens: They allow for representation of ownership rights to a unique digital or real-world asset.

These tokens, unlike cryptocurrencies, are not built on their native blockchain, so they must follow the “rules” laid out on the ones housing them. It’s a classic case of “my house, my rules”.

Tokens standards

A token standard is a set of rules or functions that a smart contract must observe to comply with regulating standards in the blockchain ecosystem built upon to make them universally compatible. There are the rules the smart contracts that the tokens facilitate have to follow. Get it?

A couple of token standards exist in the blockchain ecosystem, most of which were initially built on the Ethereum blockchain. We will be looking at the main categories supported, currently the fungible and non-fungible ones. Examples include:

ERC-20: This standard possesses common functionalities like allowing the transfer of tokens between different accounts. It serves as a standard interface for fungible tokens that possess the same value, like payment tokens (cryptocurrency) on the Ethereum blockchain. Fungible tokens created on Ethereum can be called “ERC20 tokens”. Active examples of these tokens are Chainlink (LINK), Tether (USDT), Shiba Inu (SHIB), and any other fungible tokens built on the Ethereum blockchain.

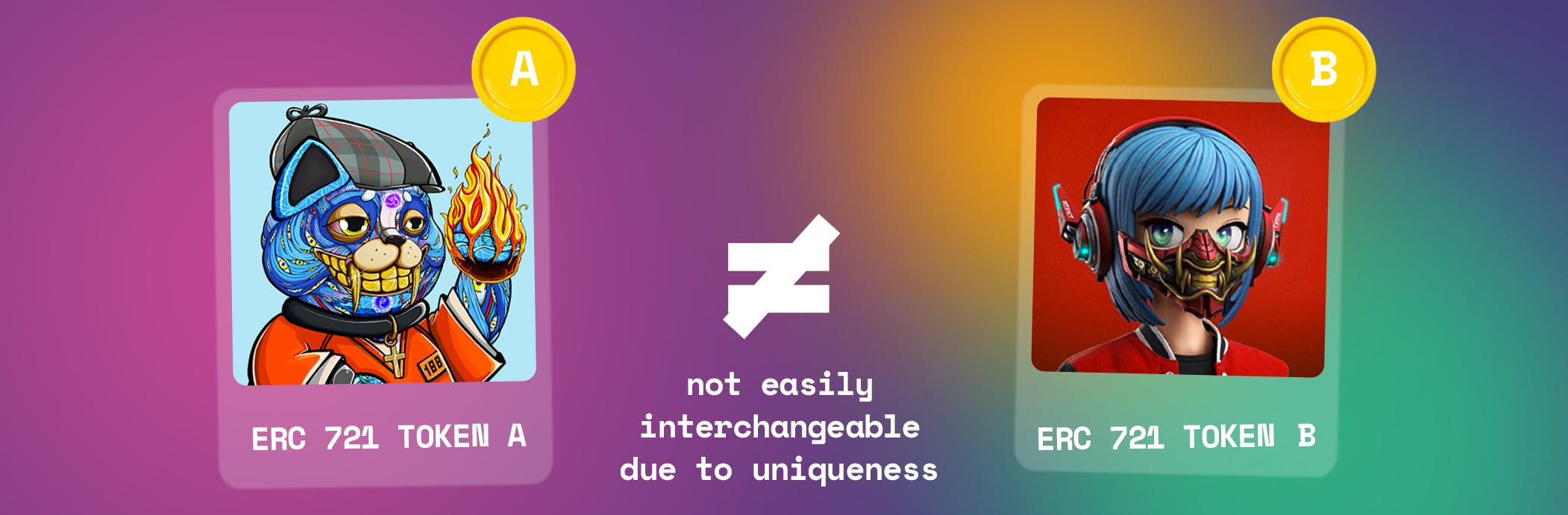

ERC-721: This token standard supports the creation of non-fungible tokens that are uniquely differentiable on the Ethereum blockchain. This means that non-fungible tokens created on the Ethereum blockchain can be called “ERC721 tokens”. An active example of these tokens in use is Unstoppable Domains, a company building individual domains on the blockchain as ERC-721 tokens to replace long cryptocurrency addresses with human-readable names.

Other token standards like ERC-1155 aim to support multiple token standards like fungible, non-fungible, and semi-fungible tokens in the same smart contract, and ERC-721R aims to add a refund functionality to the ERC-721 and 1155 token standards to curb rug pulls in the NFT ecosystem.

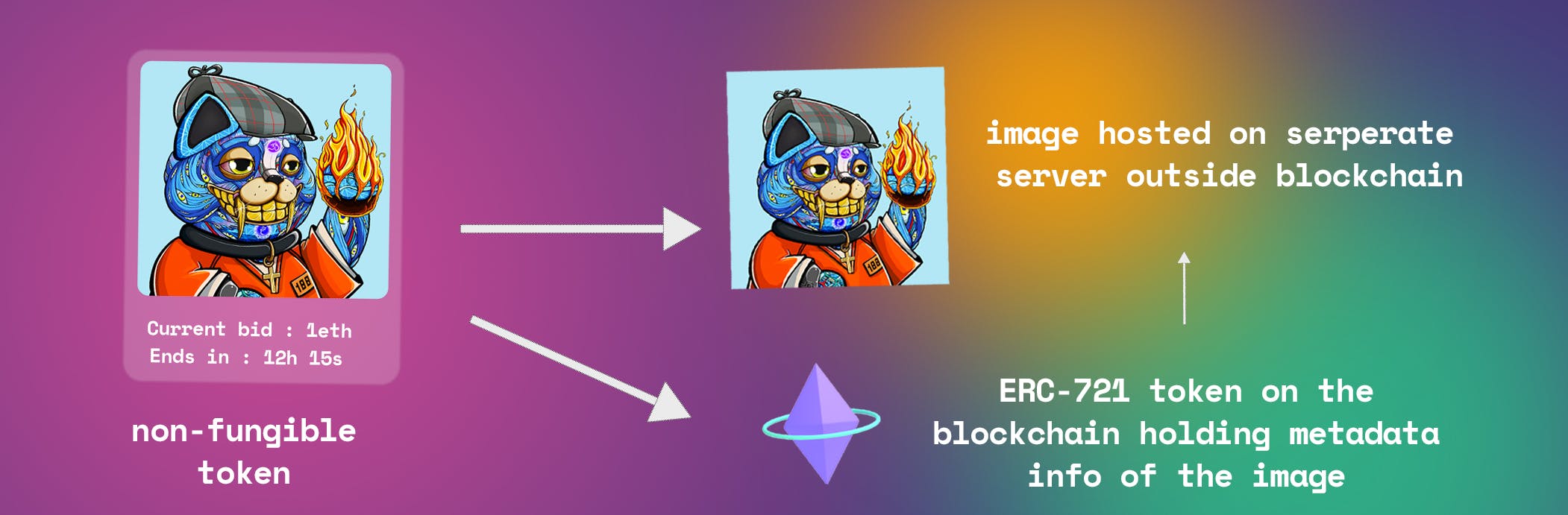

Giving you the crash course on tokens clarifies the cliche perception that famous NFTs in vogue are not the images being traded. They are just tokens or “assets” hosted on the blockchains by smart contracts and not the images themselves (more on that in a bit).

What are NFTs?

The acronym “NFT” stands for "Non-Fungible tokens". They are digital assets stored on the blockchain and cannot be traded for another. You cannot sell them for one another because they are non-fungible.

You can also define NFTs as “ERC-721 tokens” that act as ownership certificates of a digital asset on the blockchain. You cannot trade these tokens for one another because, unlike “ERC-20 tokens” like USDT or SHIB, they are non-fungible.

What does an economic term like fungibility with “seemingly overpriced digital images”? Well, let's find out.

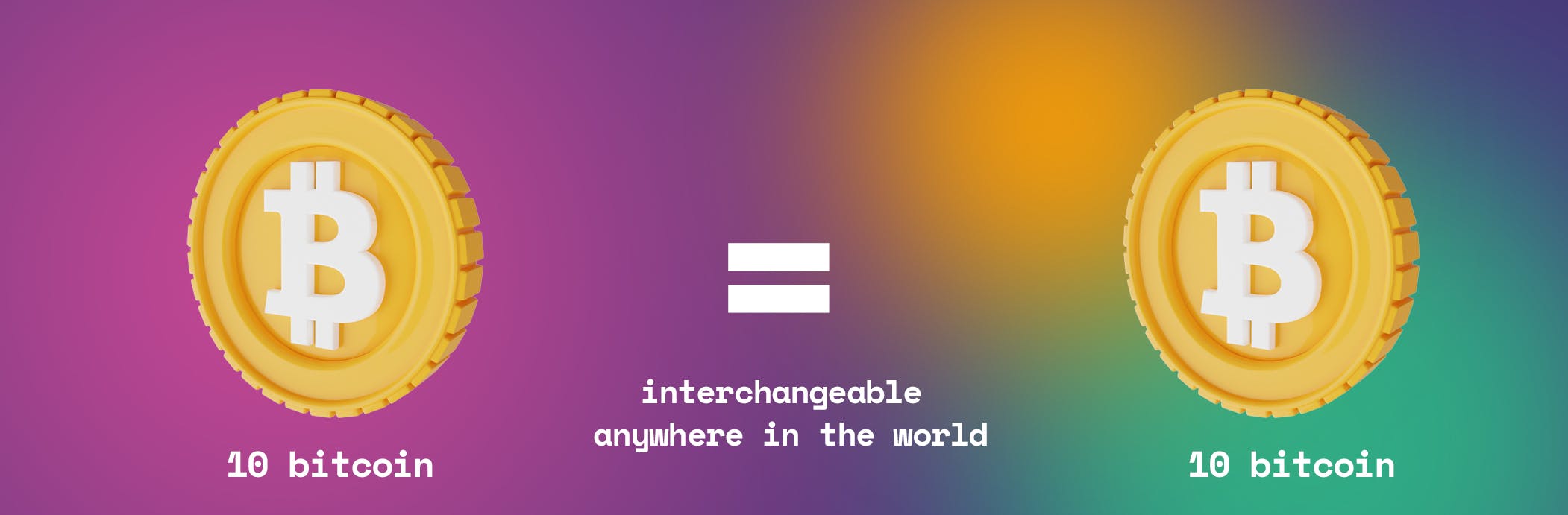

Fungibility means an interchangeable item as long as it retains its original value. An excellent example of this is currency (both real-world and crypto). A 100-dollar bill is equal to a 100-dollar bill. You could swap it for a 20-dollar bill split into five, provided it retains its original value. The dollar note is fungible.

The same goes for cryptocurrency, one bitcoin is directly equal to another, and ten Ethereum is equivalent to ten Ethereum. Cryptocurrency (ERC-20 tokens) is fungible.

Non-fungibility, on the other hand, is the direct opposite. It means an item cannot be interchangeable because it possesses a unique property or is rare.

A practical example of this is trying to exchange a one-of-a-kind limited edition jersey signed by LeBron James (he's my favorite basketballer) for perhaps a jacket owned by Elon Musk. Depending on who you ask, those items are two completely different items that aren't on the same value scale and cannot be immediately swapped for another. The same principle applies to houses (because not all houses are the same), rare Pokemon cards, art pieces, and even family heirlooms.

Get it now? So if we take all of that and sum it all up, in technical terms, we can say that an NFT is a digital asset that possesses a unique signature or property (the metadata or information in the ERC-721 token) on the blockchain. Kapische?

How exactly do NFTs work?

NFTs are created or “minted” on a blockchain. The Ethereum blockchain initially supported minting until other Layer 1 blockchains like Solana and Avalanche released support for it. Anything can be minted on the blockchain, from art pieces to audio to GIFs; as long as you can create a digital counterpart, it can become an NFT.

The blockchain (which serves as a form of public ledger) records the unique data of an NFT, meaning anyone can check the proof-of ownership of an NFT, its ownership history, and even the data linked to it. This makes for a fraud-proof system over ownership vendetta.

It is important to note that when you mint an item (for example, an image) onto the blockchain, the actual token does not hold the image itself. Those megabytes will consume a lot of space on the blockchain and will be inefficient.

You’re creating a unique ERC-721 token ID that will act as a form of ownership certificate for that image. The image is not stored on the blockchain but on a different server that you can trace back to, thanks to the token's metadata.

So, when people buy or sell these tokens or ‘NFTs”, they are simply trading their ownership rights of the token linked to the image (digital asset) and not the image itself.

What makes NFTs so valuable?

Several things make an NFT valuable. Considering the ownership verification and the fraud-proof system provided by the blockchain. Here are some reasons why they are valuable:

- Hype: NFTs are not physical, and thus to survive must possess a form of value of the same quality as its intangibility attached to it, i.e., mental or societal value. NFTs mostly make up for bragging rights (as you do not own the physical asset attached to the NFT) to “exclusive digital assets” or “rare collectibles,” and in a society where that is perceived as “cool.” It accrues value.

- Rarity: NFTs survive on a simple economic rule of supply and demand; essentially, they thrive on “rarity.” Since these tokens are unique, they possess unique properties, and in economics, high demand for a rare item leads to an increase in value.

- Utility: They are also valuable due to the utility they possess, as in the case of the Bored Ape Yacht Club, where holders of the tokens get access to exclusive membership in the club, community meetups, and other benefits.

- Ownership History: An important concept that drives NFTs its ownership history. As in the case of the Lebron James Jersey mentioned earlier, most people would be willing to own an item that belonged to someone they idolized, sometimes regardless of the price factor, i.e. (collectibles).

NFTs use cases

Let’s look at use cases for NFTs and how they can help individuals, brands, and businesses.

- Control of creative content: Artists can use NFTs to control the distribution of digital art, seeing as we can download any image with the click of a button today. Artists like Beeple have claimed ownership of their artworks and made millions from selling them as NFTs. NFTs even allow creators to attach a commission, so they receive an amount from the transaction whenever it is traded.

- NFTs in the metaverse: It’s no secret that Facebook recently changed its name to Meta to power the dream of the metaverse. Companies are building for the Metaverse dream, NFTs will play a role in it, and as we can see, people are now buying land in Decentraland as NFTs.

- NFTs can serve as a form of investment: Since NFTs are rare, they accrue value over time by increasing demand. One can hold an NFT as its values increase and later decide to sell it once the investment goal has been obtained.

- NFTs could aid transactions and represent real-world items: We can already see NFTs acting as authentic certificates to artworks. But critics speculate that NFTs will eventually be able to serve as representations for house deeds and even negative value assets like loans and aid in their trading and payments, perhaps as collaterals according to the initial proposal.

General Problem NFTs could pose

- Environmental Impact: Blockchain technology consumes a high amount of electricity, seeing as it runs on thousands of computers spread across the globe. This can lead to negative impacts on the environment. With this current dilemma in play, activists pressure companies to switch to eco-friendly power sources like solar energy. Blockchain networks like Polygon have already started making moves by going Carbon Neutral.

- Demand and Supply: NFTs thrive on rarity by following the principle of demand and supply. A few have a form of utility attached to them or perks for holders, so if a brand pushes an NFT project and customers do not buy into the idea, then the demand linked to its value will take a hit.

- Money Laundering: NFTs themselves haven’t exactly been shown or proven to be in cases involving money laundering, but they have been placed under suspicion of falling into the money laundering risk. The risks aren’t particular to NFTs, but they are believed to be another medium through which you can perpetuate the crime.

- Opportunistic money grubbers: The current boom in the NFT ecosystem has gained the attention of many people who seek to use NFTs as a business opportunity to “cash out.” While that is fine, it becomes a problem when things get a little overboard, like how the Twitter account of the late Stan Lee was used for marketing an NFT.

How to get started on your NFT journey

Now that you fully understand what Non-fungible tokens are, you might be interested in how you can be involved in the space.

Where to mint, buy and sell NFTs?

Currently, there are decentralized applications (Dapps) that serve as marketplaces and aid in the minting and trading of NFTs. Examples of those are OpenSea, Rarible, LooksRare, Foundation, Magic Eden, etc.

What you need to get started

To interact with the marketplace, you would need to own a crypto wallet like MetaMask. It acts as your account, profile, and wallet in the Web3 world, including these marketplaces.

Payment and gas (minting) fee

The form of payment on Opensea, Rarible, LooksRare, and Foundation currently is Ethereum (ETH). Still, for Magic Eden it is in Solana (SOL), so to mint, your wallet must have the equivalent amount of ETH or SOL the platform requires to mint, and if you wish to purchase an NFT, you would need to have the equal amount of ETH or SOL the NFTs have been listed for, alongside the minting fee.

Conclusion

NFTs are unique tokens that hold information and double down as a certificate of ownership. Like them or not, the concept they are based on will be helpful in different industries. No one knows where the space is going, but they have shown to be capable of offering value and utility to consumers and businesses as a whole. The current hype might be short-lived, but they will not be going away soon due to their resourcefulness.